Highlights and Key Updates

- On 12/09, CDC expanded the eligibility for the updated COVID-19 bivalent vaccines to include children ages 6 months through 5 years.

- CDC estimates that this season, there have been 13 – 27 million influenza infections, 6.1- 13 million medical visits, 120,000 – 260,000 hospitalizations and 7,300 – 21,000 influenza-related deaths between October 1 and December 3, 2022. There have been up to 2.6 times more flu-related hospitalizations this season so far compared to the entirety of last year (during which there were 100,000 hospitalizations).

- Amoxicillin and oseltamivir remain on ASHP and FDA shortage lists. The shortages of influenza and other respiratory illness medications will have compounding impacts on the surge in hospitalizations. If parents and caregivers cannot find medication for their sick children, the illness will get worse, and the parents will have no choice but to bring their children to the pediatric hospital or emergency room where we continue to see long wait times for access to healthcare. It is critical to continue mitigating supply chain disruptions around the pediatric drug shortage before hospitalization rates increase further.

- On 12/14, CDC’s Health Alert Network distributed Interim Guidance for Clinicians to Prioritize Antiviral Treatment of Influenza in the Setting of Reduced Availability of Oseltamivir, where it outlines:

- General recommendations for clinicians and public health practitioners; and,

- Guidance for prioritization when antiviral supplies are limited (per medical setting, age, and condition)

- On 12/14, CDC’s Health Alert Network distributed Interim Guidance for Clinicians to Prioritize Antiviral Treatment of Influenza in the Setting of Reduced Availability of Oseltamivir.

- As of 12/15, there is no response to AAP and CHA’s November 15 letter calling for government officials to declare a public health emergency for RSV. Federal officials point to the lack of local and state requests for an emergency declaration through departments of health and mayoral/gubernatorial offices.

- Healthcare Ready recommends that healthcare systems advocate for local declarations to access immediate resources at the state and regional levels.

- Healthcare Ready is regularly updating a map showing HHS data on pediatric hospital bed utilization. The map was last updated with data from 12/13.

- Healthcare partners are reporting that many facilities are compared to the number of licensed beds for a facility, instead of staffed and equipped beds. This may be artificially inflating bed availability in many places experiencing staffing and equipment shortages. Healthcare Ready is working to develop a new model for bed availability reporting but will report official data in the meantime. Our mapping tool notes this complication.

- As of 12/13, 71.85% of pediatric beds are occupied (-0.75 percentage points from 12/7), with four states reporting bed utilization above 90%.

- As of 12/13, states with the highest rates of in-patient pediatric bed utilization are: Idaho: 14474% (-5.93 percentage points), Nevada; 100.00% (+2.71), Arizona: 92.65% (-1.32), Utah: 91.62% (-0.11), Rhode Island: 89.63% (-3.93), District of Colombia: 89.05% (+0.48),Texas: 85.54% (-2.17), Oregon: 88.29% (-3,2), Minnesota: 84.39% (-3.61), and Maine: 82.89%.

Healthcare Ready is

ENGAGED for this event.

We are monitoring potential concerns for supply chain disruptions and impacts on healthcare services on our Pediatric Surge in Respiratory Illness response page, listing resources and previous situation reports.

Assessment of Healthcare and Logistics Impacts

Background

The confluence of respiratory illnesses is creating a surge in severe clinical presentations and hospitalizations that threaten healthcare delivery systems. Influenza and RSV activities are higher than usual for this time of year, due to relaxed pandemic-related preventative measures. It is not yet clear how the surge in respiratory illnesses will impact the capacity of facilities, such as community health centers, free and charitable clinics, urgent care, or pharmacies following the December holidays and January to March peak season. These facility types will be critical for case identification and first-line treatment.

Healthcare Ready is working to understand these impacts to best support communities with the greatest needs.

Pediatric Hospitalizations

- As of 12/13, 71.85% of pediatric beds are occupied (-0.75 percentage points from 12/7), with four states reporting bed capacity above 90%. Bed utilization estimates may be underestimated due to low participation from hospitals reporting into HHS TeleTracking. For 12/13 data, 67% of US hospitals were reporting. Local capacity may vary drastically within a given state as not all hospitals report data. As such, hospital capacity is likely more strained than reflected in the available data.

- As of 12/13, states with the highest rates of in-patient pediatric bed utilization are: Idaho: 14474% (-5.93 percentage points), Nevada; 100.00% (+2.71), Arizona: 92.65% (-1.32), Utah: 91.62% (-0.11), Rhode Island: 89.63% (-3.93), District of Colombia: 89.05% (+0.48),Texas: 85.54% (-2.17), Oregon: 88.29% (-3,2), Minnesota: 84.39% (-3.61), and Maine: 82.89%.

- Healthcare Ready is regularly updating a map showing HHS data on pediatric hospital bed utilization (snapshot, below).

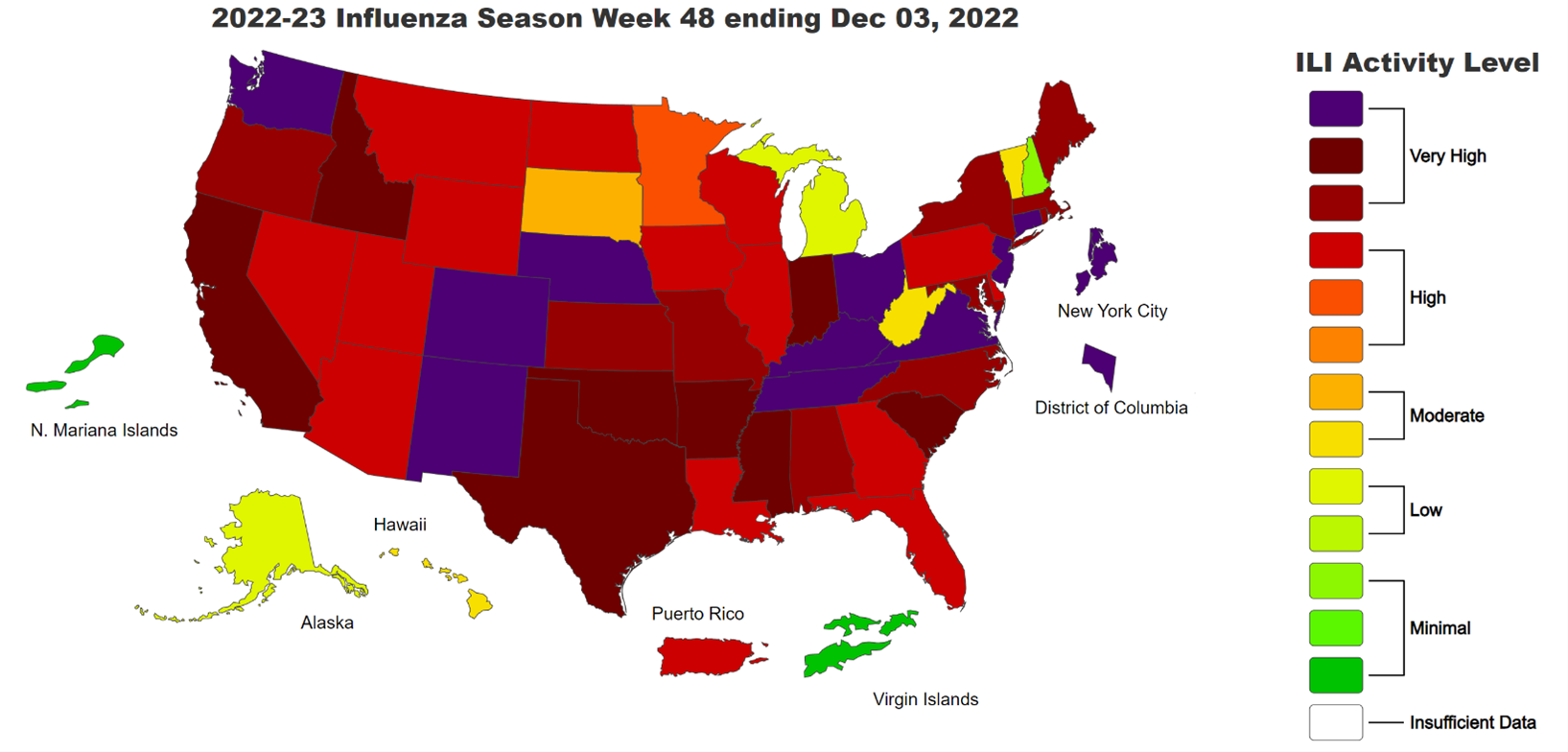

Source: CDC Outpatient Respiratory Illness Activity Map. Accessed: December 14, 2022.

COVID-19

- On 12/09, CDC expanded the eligibility for the updated COVID-19 bivalent vaccines to include children ages 6 months through 5 years.

- The Commonwealth Health Foundation study published on 12/13 found that from December 2020 through November 2022 the COVID-19 vaccination programs prevented more than 18.5 million additional hospitalizations and a 3.2 million additional deaths.

- National-level data shows a slight decrease (compared to the prior week) in new hospital admissions of pediatric patients with confirmed COVID-19. New admissions of elderly patients also decreased since the week ending in 12/03. However, new admissions of patients with confirmed COVID-19 have shown a continuous upward trend overall that began in late October. While there is a decrease since the prior week, which accounted for a spike in activity due to the Thanksgiving holidays, the COVID-19 confirmed cases and new hospital admissions continue to rise. As of 12/10, compared to the average admissions for the week ending 12/03:

- People ages 0-17: -5.0% new admissions per 100,000

- People ages 70+: -5.8% new admissions per 100,000

- If the upward trend of COVID-19 hospitalizations, not accounting for spikes that might be attributed to holidays, continues into the respiratory season, healthcare institutions might end up dealing with compounded crisis conditions and surge, putting further strain on healthcare infrastructure and workforce of these multiple populations.

- The COVID-19 public health emergency (PHE) provides a variety of federal, state, and local flexibilities in regulation and funding support for the response to RSV and flu. If the COVID-19 PHE is not renewed before its expiration mid-January 2023, between 5.3 and 14.2 million Medicaid enrollees could lose their coverage between January and April 2023.

- Federal funding for COVID-19 vaccines might run out as early as in January 2023, at which point COVID-19 vaccines and therapeutics will become available only via the commercial market.

- According to an analysis from the Kaiser Family Foundation, “private insurers will be required to take on more of the cost of vaccines (including paying for the doses themselves once the federal supply runs out), which could have a small upward effect on premiums.”

- Implications for how these changes may affect vaccine availability and out-of-pocket costs to patients will become clearer as the commercial cost of vaccines and mechanisms for distribution and purchasing are defined.

Health Equity Concerns

- Some reporting suggests pediatric patient transport, which is already constrained due to staffing, availability of hospital beds that are staffed to receive a patient, and specific supplies needed to transport a child, is especially challenging for rural areas. Ability for rural areas to move patients, especially across state lines, may be limited.

- Children with underlying conditions, especially obesity and diabetes, are more likely to experience severe COVID-19 and hospitalization. According to data from CDC’s COVID-19 Associated Hospitalization Surveillance Network (COVID-NET), during the 2021-2022 Omicron surge (December 2021 – February 2022): 70% of hospitalized children had an underlying medical condition, 19% were admitted to an intensive care unit, and children with diabetes and obesity were more likely to experience severe COVID-19.

- For the limited areas tracked by CDC’s RSV-NET* for the week ending 12/10, hospitalization rates for all races and ethnicities have fallen compared to the previous week.

- RSV-NET data shows a continued downward trend in reported RSV-associated hospitalizations.

Potential Threats for Pediatric Medical Surge

Several challenges are unique to managing pediatric medical surges, particularly for the healthcare workforce and supply chain. For one, pediatric hospitals require more intensive nursing resources to treat and monitor patients, especially in intensive care and neonatal intensive care units.

Additionally, pediatric supply chains can also be more vulnerable to supply chain disruptions, as some critical products have only one supplier or manufacturer capable of producing the necessary pediatric-specific equipment and supplies.

Product Availability

- Amoxicillin

- Amoxicillin remains in short supply.

- The majority of amoxicillin production facilities are located overseas. Domestic amoxicillin capacity is limited by staffing and active pharmaceutical ingredients (API) constraints, as well as reduction of capacity due to low demand in recent years.

- The lack of guaranteed demand prior to the respiratory season is driving a lack of surge capacity. Manufacturers of amoxicillin and other antibiotics typically determine production amounts prior to respiratory season based on the amount ordered. Manufacturers typically do not manufacture additional product beyond what is ordered because profit margins for the product are small; it would be a major risk to overproduce and not sell additional product. Contracts that guarantee demand (between manufacturers and government, distributors, and/or providers) may help mitigate shortages for future respiratory seasons.

- As of 12/8, multiple forms of amoxicillin remain on the FDA and ASHP drug shortage lists. This includes tablets, capsules, and powder for suspension. Providers and patients continue to experience impacts.

- The American Academy of Pediatrics reported on alternative therapies during the shortage.

- Tamiflu (oseltamivir)

- Tamiflu and its generic oseltamivir remain in high demand. As of 11/29, both the oral suspension and capsule formulations of oseltamivir remain on the ASHP shortages list. Oseltamivir is not currently on the FDA shortage list.

- Updated as of 12/5: FDA’s list of available antiviral medications for the 2022-2023 influenza season.

- FDA notes that while certain variations of Tamiflu are unavailable, there are no reported shortages (as of 12/7) among many companies.

- Many over-the-counter pediatric pain relievers (ibuprofen and acetaminophen) are experiencing spot shortages locally. With the exception of ibuprofen oral suspension (prescription only), which is on the ASHP Shortages list, these products are not yet on the ASHP or FDA Drug Shortage lists.

- The shortages of pediatric pain relievers as well as influenza and other respiratory illness medications will have compounding impacts on the surge in hospitalizations. If parents and caregivers cannot find medication for their sick children, their condition may worsen, and the parents will have no choice but to bring their children to the pediatric hospital or emergency room where we continue to see long wait times for access to healthcare. It is critical to continue mitigating supply chain disruptions around the pediatric drug shortage before hospitalization rates increase further.

- ASHP’s current drug shortages list includes the following drugs that could negatively impact treatment of RSV and other respiratory illnesses:

- As of 12/12: 0.9% Sodium Chloride Small Volume Bags (< 150 mL) of various sizes from six different companies have been added. There are a multitude of reasons for the shortage including increased demand, manufacturing delays, and labor shortages. A number of the companies have supplies on allocation as they work through this shortage while Fresenius Kabi expects a release date of mid-to-late December.

- As of 12/9: 0.9% Sodium Chloride Large Volume Bags of various sizes from five different companies have been added. The majority of companies stated that the reason for the shortage was due to an increase in demand. Additionally, a majority of the companies have product on allocation to their customers while Fresenius Kabi estimates a release date of mid-to-late December for the 250, 500, and 1000 mL bags.

- As of 11/30: Ibuprofen Oral Suspension (Prescription Products Only) from Teva has been added. While no reason for the shortage has been provided, we can assume it is due to or exacerbated by the surge of respiratory illnesses impacting the nation. There has been no estimated resupply date.

- As of 12/2: Oseltamivir Oral Suspension and Capsules of various sizes from 10 different companies have been added. While no reasons for the shortage was provided by the companies themselves, we can assume it was due to the increase in demand from the recent surge in respiratory illnesses. It is important to note that some formulations of the product are listed as “available.” The sizes/formulations that are in shortage will either release in late December 2022, are on allocation right now, or the company cannot estimate a release date.

- As of 12/6: 0.9% sodium chloride vials of various sizes from Fresenius Kabi and Pfizer have been added. The shortage is likely caused by increased demand, related to the application of sodium chloride for respiratory therapy. Pfizer has 0.9% sodium chloride 10 mL vials on backorder and the company estimates a release date of May 2023. Fresenius Kabi has 0.9% sodium chloride 10 and 20 mL vials on backorder and the company estimates a release date of mid- to late-December 2022.

- As of 12/6: 23.4% Sodium chloride injection of various formulations from Fresenius Kabi and Pfizer have been added. Both Fresenius Kabi and Pfizer have said the shortage is due to an increase in demand. Expected resupply dates are from mid-December 2022 to January 2023.

- As of 11/28: Ceftazidime Injection (and its generic name Tazicef) from Pfizer, Sagent, and BBraun have been added. The shortage is due to increased demand, likely due to the fact that ceftazidime is used to treat a wide variety of bacterial infections and providers could be prescribing this drug as a remedy to respiratory symptoms.

- As of 11/29: Rocuronium injection, used during tracheal intubation, is in shortage from several manufacturers due to increased demand and manufacturing delays. Estimated resupply dates vary based on manufacturer.

- FDA’s drug shortage database lists the following updates regarding drugs that may be related to treating respiratory illness:

- Reverified on 12/2: Amoxicillin oral powder for suspension is available for current customers from Hikma pharmaceuticals. As of 12/6 most of the amoxicillin oral powder product for suspension from Sandoz is unavailable while some has limited availability. Additionally, as of 12/6, products from Aurobindo and Teva are on allocation.

- Reverified on 12/6: albuterol sulfate, a bronchodilator for oral inhalation, manufactured by Akorn Pharmaceuticals, remains unavailable and is estimated to be back in stock by Q2 2023. A 5 mL version from Nephron Pharmaceuticals is available.

- FDA’s medical device shortage database lists the following updates regarding medical devices that may be related to treating respiratory illness:

- Definitions for product shortage vary by organization. Healthcare Ready sources data from multiple organizations that maintain drug shortage lists, including:

- American Society of Health-System Pharmacists (ASHP), which defines a drug shortage as “a supply issue that affects how the pharmacy prepares or dispenses a drug product or influences patient care when prescribers must use an alternative agent.”

- US Food and Drug Administration (FDA), which defines a drug shortage as “a situation where the total supply of all versions of the approved product available at the user level will not meet the current demand, and a registered alternative manufacturer will not meet the current and/or projected demands for the potentially medically necessary use(s) at the user level.”

- On 11/22, the FDA issued an emergency use authorization (EUA) for the Lucira COVID-19 and influenza multiplex test for use in a point-of-care (POC) setting. This will expand the testing kit pool as well as reduce the strain on the testing kit supply chain as two tests are combined into one.

Treatments for RSV

A monoclonal antibody therapy called palivizumab is available as a precautionary measure to prevent severe RSV illness in certain infants and children at high risk for severe disease during the normal respiratory season. It cannot cure or treat children who are already suffering from severe cases of RSV; it is a preventative treatment.

- On 11/17, AAP updated its guidance: Given the known efficacy of palivizumab along with the unpredictable surge capability of RSV, AAP recommends programmatic consideration of providing more than five consecutive doses of palivizumab depending on the duration of the current RSV surge in a particular region of the country.

- Palivizumab is sold under the brand name Synagis, and is marketed by Sobi in the United States. Sobi purchased US rights to Synagis from AstraZeneca in 2018. Before COVID-19, physicians prescribed Palivizumab more frequently as a preventative measure, yet, this treatment strategy slowed during the pandemic.

- AAP says that it recommends Palivizumab in eligible infants in regions that are experiencing high rates of RSV and that it will release updated guidance as they monitor the seasonal trends.

Workforce ShortagesWorkforce shortages continue to impact access to care in hospitals around the country.

Resident physicians,

doctors,

hospitals staff are advocating for increased federal support.

Ongoing

workforce shortages may threaten the ability of facilities to establish a predictable quality of care for patients. Because pediatrics is a specialty practice, there may be

additional strain on the workforce with pediatric care experience. Reports indicate that

pediatricians are requesting increased federal support as they deal with RSV, COVID-19, and influenza treatment in unison. Physicians state that they can

only successfully handle this “tripledemic” with the assistance of a federal emergency declaration and dissemination of support. The Administration for Strategic Preparedness and Response (ASPR), Technical Resources, Assistance Center, and Information Exchange (TRACIE) team has a staffing resources section on their pediatric surge response resources page, which can be found

here.

Hospitals and other healthcare facilities may need

to increase surveillance for respiratory illnesses among staff to reduce the spread and the potential for staff being out sick.

Practitioners’ mental health should also be considered and protected.

Additional training and support for practitioners that are not used to caring for acute pediatric cases for prolonged periods should be provided whenever possible.